https://abcnews.go.com/Politics/state-department-orders-emergency-government-employees-iraq/story?id=63046559

2019-05-15 09:25:00Z

52780296466247

WASHINGTON — The State Department ordered a partial evacuation of the United States Embassy in Baghdad on Wednesday, responding to what the Trump administration said was a threat linked to Iran, one that has led to an accelerated movement of American ships and bombers into the Persian Gulf.

The department ordered “nonemergency U.S. government employees,” at both the embassy in Baghdad and the consulate in Erbil, to leave the country. The order applies primarily to full-time diplomats posted to Iraq by State Department headquarters in Washington, and an embassy statement said that visa services in Iraq would be suspended as a result. Contractors who provide security, food and other such services will remain in place for now.

The State Department made the decision despite skepticism from Iraqi officials about the purported threat. Secretary of State Mike Pompeo said last week that the administration had received intelligence related to “Iranian activity” that put American facilities and service personnel at “substantial risk.” Other American officials have said the same piece of intelligence points to potential attacks by Shiite Arab militias tied to Iran against American troops in Iraq or Syria.

Mr. Pompeo made a surprise visit to Baghdad on May 7 to brief Iraqi leaders about the threat. Since then, Iraqi officials have expressed doubts about it. A British general told reporters in the Pentagon on Tuesday that he saw no increased threat from Iran or allied militias in Iraq or Syria.

On May 5, John Bolton, the national security adviser, issued a statement warning against any attack by the Iranian military or a “proxy” against American interests or allies. Mr. Bolton said the United States was sending the U.S.S. Abraham Lincoln carrier strike group and bombers to the Persian Gulf. Other officials later said that the strike group’s movement to that area had been previously scheduled and was merely being sped up.

On Friday, the Pentagon said it was sending another ship and a Patriot antimissile battery to the Middle East.

The order for a partial evacuation of the Baghdad embassy, which at the height of the Iraq War was the largest in the American diplomatic system, adds to the rising tensions between the United States and Iran. It is unclear when the employees being evacuated will be told they can return.

In September, Mr. Pompeo ordered a full withdrawal from the American Consulate in Basra, in southern Iraq, after a few rockets landed around the grounds of the city’s airport, where the consulate is. The rockets did not cause any injuries. For more than a year beforehand, State Department officials had debated whether to shut down the consulate to save money, and some diplomats said the evacuation of the consulate was related to that.

The Trump administration blamed Shiite militias tied to Iran for the rocket attacks in Basra. It also said that those types of militias were responsible for rocket attacks around the same time in the area of the Baghdad embassy. As in Basra, the attacks in Baghdad did not injure anyone.

Tensions with Iran have been rising since May 2018, when President Trump withdrew the United States from the 2015 nuclear deal that world powers reached with Tehran. The United States then reinstated major sanctions last November, and those have weakened the Iranian economy.

In April, the Trump administration designated an arm of Iran's military as a foreign terrorist organization and ended waivers it had granted to eight governments to exempt them from sanctions for buying Iranian oil.

European nations are still in the nuclear deal and have urged Iran to stay committed to it, despite Mr. Trump’s provocations. Iran said last week that it would begin walking away from some of the deal’s restrictions on its nuclear activity.

Critics of the Trump administration, and of Mr. Bolton in particular, have suggested that American officials are presenting faulty intelligence to make a case for war against Iran, as the administration of President George W. Bush did in 2002 to justify the invasion of Iraq. Mr. Bolton was the under secretary of state for arms control and international security then, and he asserted that Saddam Hussein, the longtime ruler of Iraq, was trying to develop weapons of mass destruction.

BEIJING (Reuters) - China is running out of options to hit back at the United States without hurting its own interests, as Washington intensifies pressure on Beijing to correct trade imbalances in a challenge to China’s state-led economic model.

FILE PHOTO: Containers are seen at the Yangshan Deep Water Port in Shanghai, China April 24, 2018. REUTERS/Aly Song/File Photo

China said this week it would impose higher tariffs on most U.S. imports on a revised $60 billion target list. That’s a much shorter list compared with the $200 billion of Chinese products on which Washington has hiked tariffs.

Washington has also turned up the heat on other fronts, from targeting China’s tech firms such as Huawei and ZTE to sending warships through the strategic Taiwan Strait.

As the pressure mounts, Chinese leaders are pressing ahead to seal a deal and avoid a drawn-out trade war that risks stalling China’s long-term economic development, according to people familiar with their thinking.

But Beijing is mindful of a possible nationalistic backlash if it is seen as conceding too much to Washington.

Agreeing to U.S. demands to end subsidies and tax breaks for state-owned firms and strategic sectors would also overturn China’s state-led economic model and weaken the Communist Party’s grip on the economy, they said.

“We still have ammunition but we may not use all of it,” said a policy insider, declining to be identified due to the sensitivity of the matter.

“The purpose is to reach a deal acceptable to both sides.”

The State Council Information Office, finance ministry and commerce ministry did not immediately respond to Reuters’ requests for comment.

Of the retaliatory options available to China, none come without potential risks.

Since July last year, China has cumulatively imposed additional retaliatory tariffs of up to 25 percent on about $110 billion of U.S. goods.

Based on 2018 U.S. Census Bureau trade data, China would only have about $10 billion of U.S. products, such as crude oil and big aircraft, left to levy duties on in retaliation for any future U.S. tariffs.

In contrast, U.S. President Donald Trump is threatening tariffs on a further $300 billion of Chinese goods.

The only other items Beijing could tax would be imports of U.S. services. The United States had a services trade surplus with China of $40.5 billion in 2018.

But China does not have as much leverage over the United States as it might seem because large parts of that surplus are in tourism and education, areas that would be more difficult for the Chinese government to significantly roll back, James Green, a senior adviser at McLarty Associates, told Reuters.

China is more likely to further erect non-tariff barriers on U.S. goods, such as delaying regulatory approvals for agricultural products, said Green, who until August was the top U.S. Trade Representative official at the embassy in Beijing.

Trade analysts say China could reward other global companies at the expense of U.S. firms, replacing for example Boeing planes with Airbus jets where possible.

But there is considerable risk for China in transitioning its retaliation from tariffs to non-tariffs barriers on U.S. companies because doing so would intensify perceptions of an uneven playing field in China and incentivise some firms to shift sourcing or investment outside the country, they say.

Trump has called for U.S. firms to move production back to the United States.

“The medium- to long-term ramifications on supply chains are being deeply underestimated. I would be severely concerned if I was China,” Robert Lawrence, a nonresident senior fellow at the Peterson Institute for International Economics, recently told journalists in Beijing, where a group from the think-tank met with senior Chinese officials.

After trade negotiations hit a wall last week and led to the imposition of new tariffs, Chinese state media has stepped up nationalist rhetoric, vowing that China won’t be bullied.

But analysts say Beijing, at least for the time being, is trying to keep the trade war from seeping into the larger political arena.

“I don’t think they see that as in their interests, and are worried that anti-Americanism becomes anti-regime very quickly,” said Green.

A weaker yuan could help mitigate the impact on China’s exports from higher U.S. tariffs, but any sharp yuan depreciation could spur capital flight, analysts say.

Chinese leaders have repeatedly said they will not resort to yuan depreciation to boost exports, and the central bank has said it will not use the currency as a tool to cope with trade frictions.

The yuan has lost just over 2 percent against the dollar so far this month as the trade war intensifies, but analysts said the depreciation is likely to be market-driven.

Investors are concerned that China, which is the largest foreign U.S. creditor, may dump Treasury bonds and send U.S. borrowing costs higher to punish the Trump administration.

But most analysts say such an action by China is unlikely as it risks starting a fire sale that would burn its own portfolio too.

China’s massive Treasury holdings totaled $1.131 trillion in February, according to the latest U.S. data.

The near-term shock to China’s economy from higher U.S. tariffs could be mitigated by increased policy stimulus to spur domestic demand.

Chinese exporters are diversifying overseas sales, helped in part by Beijing’s Belt and Road initiative to recreate the old Silk Road.

To meet its demand for raw materials, China is also seeking alternative overseas suppliers.

Chinese purchases of U.S. soybeans - once China’s biggest import item from the United States - came to a virtual halt after Beijing slapped 25% tariffs on U.S. shipments last year.

Beijing has since scooped up soybeans from Brazil.

Reporting by Kevin Yao and Michael Martina; Additional reporting by Hallie Gu; Editing by Ryan Woo & Shri Navaratnam

The Volkswagen T-Cross model stands on a lifting platform in a car tower on the Volkswagen factory premises.

picture alliance | picture alliance | Getty Images

President Donald Trump's next trade battle could involve the U.S. slapping steep tariffs on auto imports from Europe — but that wouldn't really be the White House's ultimate goal, one expert said Wednesday.

Instead, such a move may well prove to be a "Trojan horse" for a bigger deal on agriculture, according to David Hauner, head of cross-asset strategy and economics for Europe, the Middle East and Africa at Bank of America Merrill Lynch.

Now that Trump has imposed more tariffs on Chinese goods, all eyes are turning to a potentially brewing trade war between the U.S. and Europe. The president had threatened as early as last year that he would slap a 25% tariff on car imports from the European Union. So far, however, the tariffs have not been imposed — but Trump is due to make a decision on European auto imports by May 18.

According to Hauner, however, the White House may have a tough road ahead.

"We think there will at least be an attempt by the U.S. to push for some sort of concessions from Europe. It's gonna be very difficult particularly if Trump actually starts a discussion about agriculture," he told CNBC's "Squawk Box."

He added: "Some say that car tariffs might ... be a Trojan horse to actually start discussions about agriculture, because that's where really the big business for the U.S. and Europe would be. Agriculture and Europe is politically very very sensitive when it comes to allowing American imports."

Farmers — a key political constituency for Trump — have seen their fortunes suffering from the trade war with China, and that's potentially a concern for the president ahead of his 2020 re-election bid.

Since his tariff threat against European autos, Trump has met the president of the European Commission, the EU's executive body, and both decided to seek an agreement over trade and avoid tariffs. Nearly a year since their meeting, both sides have yet to start those official trade talks.

But analysts have pegged the tariffs on Chinese goods as a sign of what's to come for Europe. Last Monday, European auto stocks fell more than 3% following Trump's tariffs announcement over the weekend.

There could still be a deal as long as the U.S. keeps the trade discussions with the European Union to autos only, according to Hauner.

But, he said, "If the discussion will include agriculture, then it gets really, really dicey."

"Europe is really collateral damage here because Europe has not enough domestic growth. It really depends so much on trade and that is now really its Achilles' heel," Hauner added.

According to the Office of the United States Trade Representative, U.S. imports for consumed agricultural products from EU countries totaled $23.9 billion in 2018, while U.S. agricultural goods exports to the EU was $13.5 billion.

Auto imports from EU countries were worth $56.4 billion. Overall, the U.S. goods trade deficit with EU countries was $169.3 billion in 2018, an 11.8% increase over 2017, according to the USTR.

Since taking office, Trump has called out major trading partners including the EU, China and Canada for what he's deemed unfair practices that hurt American workers and companies.

Any U.S. tariffs on European cars would hit Germany's important automobile industry particularly hard. The United States is Germany's most important single export destination after the bloc of EU countries.

— Reuters and CNBC's Yen Nee Lee contributed to this report.

The cost of your sneakers or high heels could soon jump, thanks to another round of tariffs under consideration by the Trump administration as part of an ongoing trade war with China.

The White House on Monday released a fresh list of about $300 billion in Chinese goods that could get hit with 25% tariffs, if President Donald Trump decides to move forward with his threat. The list includes footwear — everything from sneakers to sandals, golf shoes, rain boots and ski shoes.

Should the tariff increase ultimately take effect, analysts say consumers would feel the brunt of the impact. And the American footwear industry is particularly dependent on China.

In 2017, China accounted for about 72% of all footwear imported into the U.S., according to the American Apparel and Footwear Association. The U.S. imported $11.4 billion worth of footwear from China last year, according to data from the U.S. Census Bureau.

"While brands have moved their production into other countries in Asia because labor costs are lower there, everybody is still making shoes in China," said Matt Powell, a sports analyst for NPD Group. "The Chinese have years of expertise. They tend to be the best at making high-value product."

Both Nike and Adidas — the top two sneaker makers in the U.S. by sales — have steadily been easing their reliance on China, shifting production to Vietnam instead. Both companies declined to comment when reached by CNBC.

Puma has said it's working to do more of the same. But China still dominates when it comes to footwear manufacturing.

"For a lot of working families who buy shoes at Walmart, Target and these other retailers ... a ton of volume runs through [China], " said Matt Priest, the president and CEO of the Footwear Distributors and Retailers of America, a trade organization. The proposed tariffs on footwear "are concerning to say the least," he said. "It's every single type of shoe."

FDRA said a popular type of canvas "skate" sneaker, currently retailing at $49.99, with a 25% tariff, could increase to $65.57. The price of a typical hunting boot would increase from $190 to $248.56. And a popular performance running shoe could jump from $150 to $206.25, FDRA said.

Ultimately, a 25% tariff on footwear could cost shoppers more than $7 billion each year, Priest said — what he called a "conservative" estimate.

— CNBC's Jessica Golden contributed to this reporting.

WATCH: Cramer explains which businesses have the most exposure to the trade war

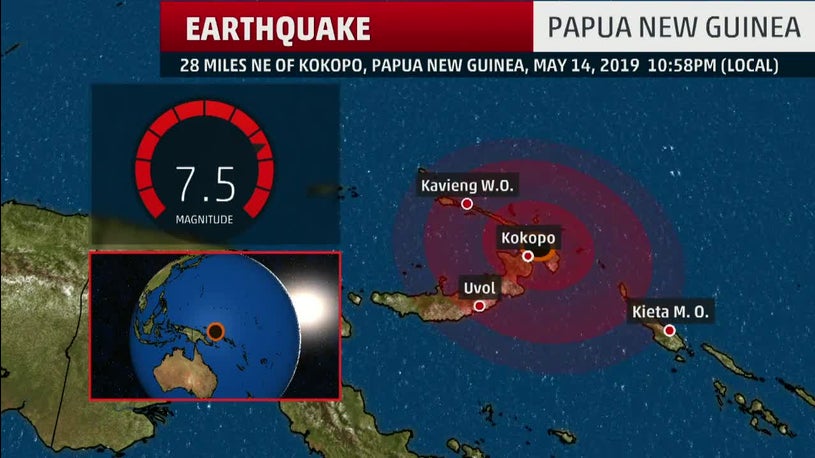

A magnitude 7.5 earthquake has struck Papua New Guinea, according to the U.S. Geological Survey.

There were no immediate reports of injuries or damage.

A tsunami alert was issued for Papua New Guinea and the Solomon Islands but was later cancelled.

The epicenter of the quake was about 28 miles northeast of Kokopo, in New Britain province. The city is on a smaller island northeast of the main island and about 495 from the the capital of Port Moresby.

Papua New Guinea sits on the Pacific "Ring of Fire," named for its active volcanoes and earthquakes. About 90 percent of Earth's quakes happen along this 25,000-mile horseshoe that loops from South America to Europe and back down to the coast off Australia.

A magnitude 7. 2 quake struck the country's main island on May 7, but no injuries or damage were reported.

In the past century, 36 earthquakes of magnitude 7.0 or larger have been reported within 150 miles of the epicenter of today's quake. Three of those were magnitude 8.0 or larger, including one in November 2000 that triggered landslides and at least one death, and left thousands homeless.

The Weather Company’s primary journalistic mission is to report on breaking weather news, the environment and the importance of science to our lives. This story does not necessarily represent the position of our parent company, IBM.