President Joe Biden has announced the release of oil from the US’s strategic stockpile in an attempt to drive down petrol prices and snuff out a crude market rally that the White House has said poses a threat to the global economic recovery.

The White House said on Tuesday that the president was authorising the release of 50m barrels of oil — about 2.5 days worth of US oil consumption — “over the coming months”, in a move co-ordinated with China, India, Japan, South Korea and the UK.

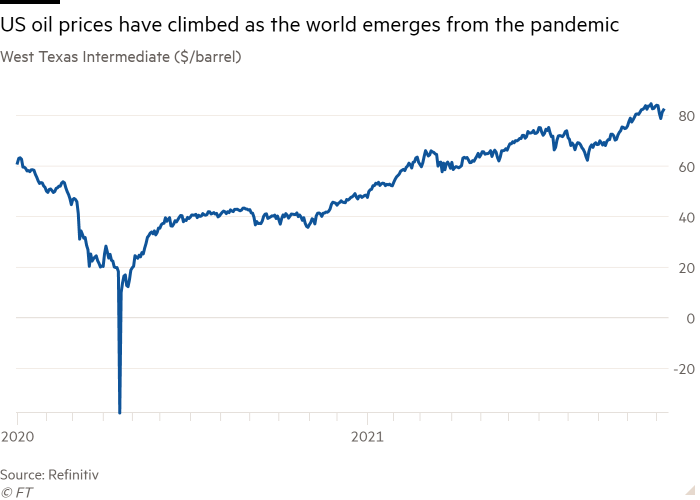

But an effort to drive down oil prices that have doubled in the past year appeared to backfire, as international crude benchmark Brent rose more than 2 per cent on the news, to trade at about $81.40 a barrel on Tuesday morning in London.

Biden linked the release to efforts to beat back sharply rising inflation, saying Americans were “feeling the impact of elevated gas prices at the pump and in their home heating bills, and American businesses are, too, because oil supply has not kept up with demand as the global economy emerges from the pandemic”.

The decision comes weeks after a US government official told the Financial Times that an oil release was being considered. Saudi Arabia, Russia and other members of the Opec+ group of oil exporters have rebuffed repeated US pleas to increase supply.

Oil prices rose on the news, as traders calculated that the total volume to be released would be less than expected, and that Opec+ could retaliate by holding back more oil than planned. Opec did not respond to requests for comment.

The release is the largest release of crude oil from the US’s Strategic Petroleum Reserve — an emergency stockpile created in the wake of the 1970s oil crises — since the civil war in Libya caused a rise in crude prices in 2011.

Analysts said it was unlikely to have the impact on prices Biden hoped it would and that it was a misuse of the emergency reserve.

“A co-ordinated raid of emergency stockpiles absent a geopolitical disruption — and intended to influence global oil prices — is a fateful energy policy precedent that is likely to backfire,” said Bob McNally, head of Rapidan Energy Group and a former adviser to the George W Bush White House.

The UK will release 1.5m barrels, and India will release 5m barrels. Volumes from other countries have not yet been confirmed.

The US will release 32m barrels “over the next several months” as part of an exchange allowing it to replenish the stocks later. The other 18m barrels to be released involve an accelerated sale of oil already authorised by Congress and expected by the market.

Biden is facing growing political pressure to tame petrol prices — up 60 per cent in the past 12 months — and other sources of high inflation, which have hit the approval ratings of both the president and other Democrats in Congress heading into next year’s midterm elections.

Senior administration officials said they had remained in contact with oil-producing countries in recent weeks, making clear that their “preference” was for them to take action, but also that they would “use the tools at the president’s disposal” to “respond to the current price and supply environment” without them.

The International Energy Agency, the oil-consuming nations’ watchdog that co-ordinated oil releases in the past, was not part of the White House’s announcement. Some members, including Germany, were opposed to an IEA-wide release, according to a person familiar with the matter.

The agency said it recognised that the rise in oil prices had placed a burden on consumers and added to inflationary pressures. “In this context, we respect the assessments and decisions made by individual IEA member and partner countries on how best to respond to the specific challenges and circumstances they each face,” it said.

One senior Biden official said: “Opec+ has said that they are planning to release an additional 400,000 barrels a day starting in December and our hope and expectation [is that] they will continue on that course.”

The American Petroleum Institute, a Washington oil lobby group, said any impact from the SPR release “is likely to be shortlived unless it is paired with policy measures that encourage the production of American energy resources”.

US oil production is down about 12 per cent compared with record highs set before the pandemic and has recovered slowly, even though crude prices have doubled in the past year.

Senior Biden administration officials also stressed that they were not just looking for oil prices to come down, but for that to be reflected in petrol prices. Biden last week called on the Federal Trade Commission, the US competition watchdog, to crack down on price gouging in the sector.

“We, of course, think it’s not just important for oil prices to fall, but prices to fall at the pump, which is why we’re also so focused on making sure that prices pass through quickly to consumers as they should,” said one senior administration official.

Additional reporting by Jim Pickard in London, Myles McCormick in New York and Amy Kazmin in New Delhi

Are you interested in energy stories? Our journalists want to know what you like about our coverage, and what you want to read more of. Let us know in this short survey. Thank you

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50LzRlN2YyNTkwLTFhNGYtNDc5Mi05ZTY0LWVhZmFiZGVmNjUzNNIBAA?oc=5

2021-11-23 15:16:44Z

1186906051

Tidak ada komentar:

Posting Komentar