EU leaders at a summit are struggling to agree an oil embargo against Russia that exempts a key supply route — a concession aimed at appeasing Hungary, which has been blocking the sanctions for nearly a month.

The watered-down embargo will include oil and petroleum products but will crucially allow a “temporary” exemption for crude delivered by pipeline, according to draft conclusions seen by the Financial Times.

The conclusions are still subject to change and diplomats have not agreed how long any carve-out of oil supplied via pipeline would last.

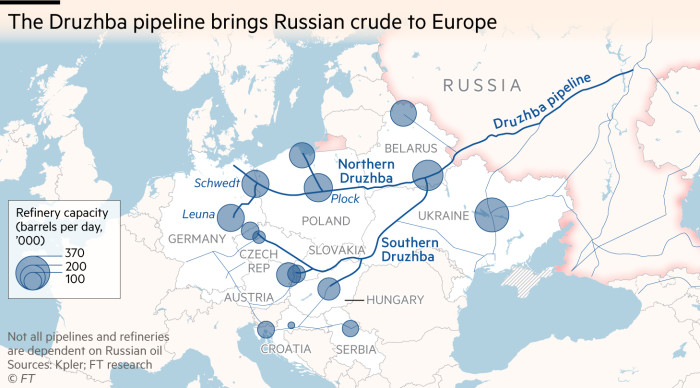

Keeping pipelines out of any embargo has been a key demand of Hungary, which has argued that a ban would put its economy at risk given its reliance on crude delivered by the Druzhba (Friendship) pipeline from Russia.

But on his way into the Brussels summit on Monday, Hungarian prime minister Viktor Orbán insisted there still was no deal and that he wanted guarantees Budapest could still access Russian oil from other sources if there was an “accident” with Druzhba, which crosses Ukraine.

He also accused the European Commission of “irresponsible” behaviour in failing to ensure security of supply for Hungary in its proposals.

Baltic leaders, who have been pushing for an oil embargo, stood in stark contrast to Orbán — paving the way for potential acrimonious discussions during the leaders’ dinner.

Kaja Kallas, Estonian prime minister, said it was “up to everybody’s moral compass how to proceed with this”, while Arturs Kariņš, her Latvian counterpart, asked Orbán to look at the big picture: “It’s going to cost us more, but it’s only money. The Ukrainians are paying with their lives.” Asked whether he believed there was any possibility of a compromise to help end the war, Kariņš said: “The right compromise is for Russia to lose the war.”

Arriving at the summit, Ursula von der Leyen, the commission president, said she had “low” expectations that the outstanding differences over the terms of the oil embargo would be resolved in the coming 48 hours, but they could be settled thereafter.

An embargo solely on seaborne oil purchases would cover about two-thirds of Europe’s imports from Russia.

A move to ban only Russian seaborne crude also risks distorting competition in the EU oil market, with refineries connected to pipelines from Russia enjoying a big advantage. The price of Russian oil has fallen to a huge discount as European traders have shunned the country’s seaborne crude since the invasion of Ukraine.

If exports via Druzhba are at the pipeline’s maximum capacity of 750,000 barrels a day, it would help Russia earn in the region of $2bn a month from EU buyers.

Russian Urals crude is trading at about $93 a barrel compared with $120 for Brent, the international oil benchmark. While Russian oil delivered via Druzhba may not carry such a big discount, depending on how contracts are structured, Hungarian oil group MOL has said it has enjoyed “skyrocketing” margins for its refineries since March owing to the “widening Brent-Ural spread”.

The draft summit conclusions say ministers need to ensure a “level playing field” for oil purchases.

According to draft legislation seen by the FT, the ban will include a restriction on re-exporting Russian oil to other member states and a prohibition of services including the financing of oil shipments.

Brussels proposed an embargo on buying Russian oil in early May, underlining the EU’s difficulties in finding a way to extend punishments on Moscow for its war on Ukraine while not damaging parts of the European economy that depend on Russian energy. The EU has already banned Russian coal but exempted gas from sanctions.

Germany has two refineries served by the Druzhba pipeline and takes about 50 per cent of what it supplies. Poland takes 16 per cent, Slovakia 13.5 per cent, Hungary and Slovenia a combined 11 per cent and the Czech Republic 9.5 per cent, according to IHS Markit, a unit of S&P Global.

Volumes shipped via Druzhba have actually increased since Russia invaded Ukraine, with buyers in the EU looking to take advantage of the large discounts or to stock up ahead of any embargo.

Argus, an energy-price reporting agency, said that while seaborne shipments from Russia to Europe had fallen by 500,000 b/d, Druzhba shipments had risen by 100,000 b/d in April compared with January and were expected to increase again in May. Hungary has increased shipments by 65,000 b/d while Poland has imported an additional 130,000 b/d, helping to more than offset declines elsewhere.

The fact that refineries connected to pipelines from Russia will enjoy a huge competitive advantage as a result of the EU’s planned sanctions could have the perverse effect of benefiting Rosneft, the Russian state oil company. It owns 54 per cent of the Schwedt refinery in eastern Germany which is directly connected to the Druzhba pipeline.

Any final deal on the sixth sanctions package would need to be approved by all 27 member states. Alongside a partial oil ban, the package would include the ejection of Sberbank from the Swift messaging system as well as restrictions on more state-owned Russian broadcasters and a new round of asset freezes and travel bans on individuals.

One EU diplomat said it was vital to maintain bloc unity and progress on the sanctions package. “Is there an agreement on an embargo on oil? Yes. Is there an agreement it will be in two phases? Yes. Is there an agreement on a date? It is more complicated. We will keep working on the package.”

Additional reporting by Victor Mallet in Brussels, Eleni Varvitsioti in Athens and Marton Dunai in Budapest

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50L2FjYzU1YWVlLTFiNjMtNGYyMy1iNTJkLTQxZmU2NjFiMDcxNNIBAA?oc=5

2022-05-30 16:22:37Z

1443529807

Tidak ada komentar:

Posting Komentar