In isolation, a modest slide in the economy of 0.2% over three months might fall into the category of regrettable but unsurprising in the circumstances.

But looking ahead, the Bank of England and others anticipate that this is the first of a run of several quarters marking the start of a lengthy recession. And looking backwards now, it is very concerning that the UK economy remains smaller than just before the pandemic three years ago.

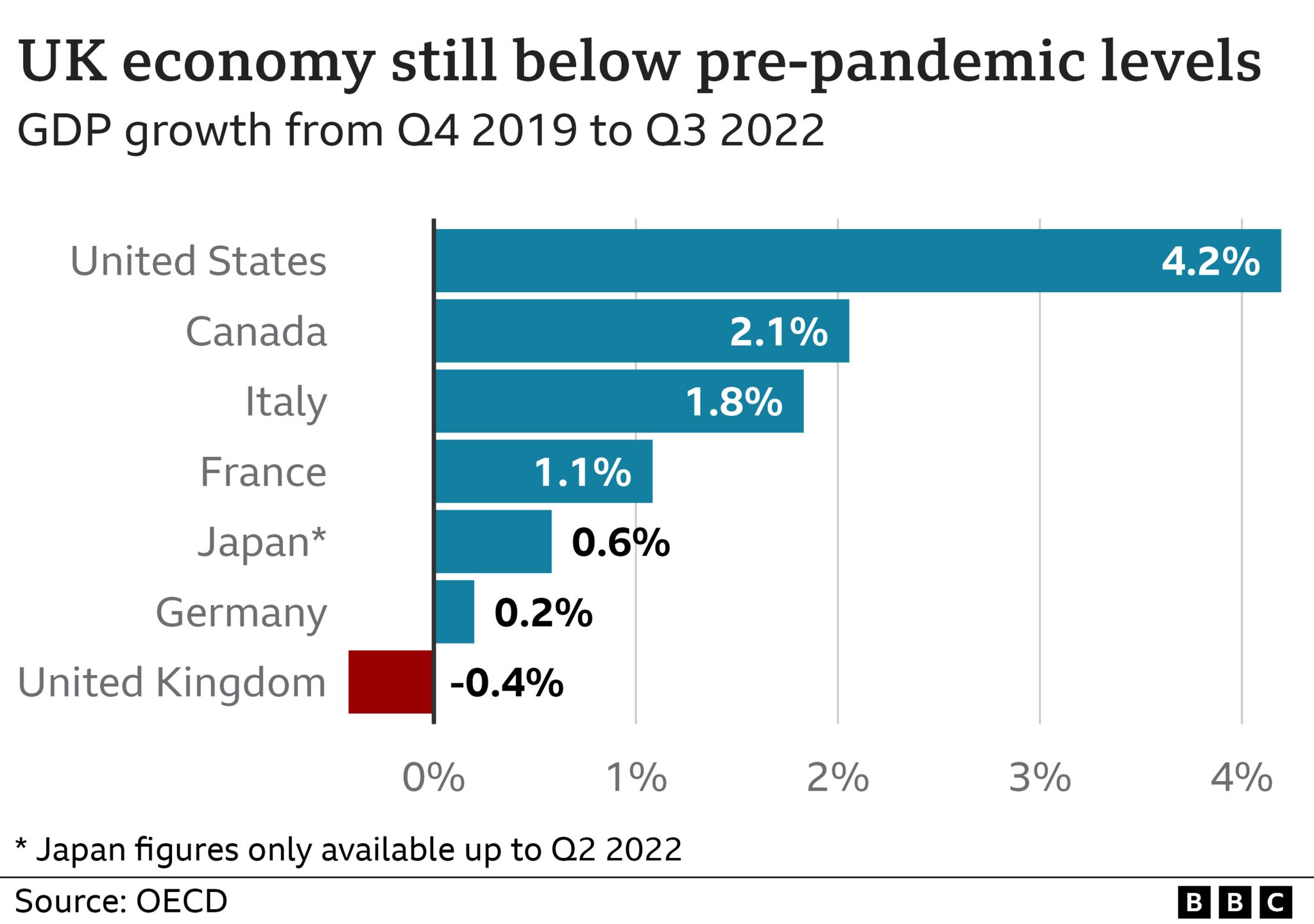

Not only is the UK the only major economy to be shrinking in the three months to September, but it is the only one not to have recovered in full the chunk of the economy lost during the pandemic. Amazingly, the UK still has an economy 0.4% smaller than in the quarter before the pandemic in Q4 2019.

That is not the case for the US (+4.2%), Canada, Italy or France, by some margin, and for Japan and Germany too. If forecasts are right about a prolonged recession, it could be half a decade without growth encompassing the whole of this Parliament, and the whole of the period since actual Brexit.

So yes there are many pressures that are global, from Covid to the European energy squeeze. But there are real questions now as to why the UK has been hit more than most.

And while some of the monthly hit in September can be explained by the extra bank holiday, the hit from the mini-budget financial chaos only affected a few days of these figures.

The official rationale is that the UK is being buffeted both by the European energy shock arising from Russia's invasion of Ukraine, and at the same time, by the US-style overheating jobs market.

While the EU is more physically dependent on actual supplies of Russian gas, the UK is more dependent on imported gas full stop, and the price paid for it has rocketed for everyone.

That energy shock has made the country unavoidably poorer, and yet, despite the weak economy, the UK is enduring significant labour supply challenges, holding it back more. Indeed the data shows "global challenges" are hitting the UK harder than other major economies - that Britain has a bespoke supply problem, worsening economic trade-offs.

The first year of the pandemic damaged the UK more than most economies. This was the textbook expectation from many economic experts of the government's approach to post-Brexit policy. It is more difficult for small businesses, especially, to trade with Europe, and the UK, by design, now has more limited access to pools of European workers. As a result the economy is less productive, less resilient, less flexible and less responsive.

As interest rates continue to rise and taxes and spending are squeezed further at next week's Autumn Statement, the economic pressures will only intensify. There are difficult trade-offs for all - the Bank of England, the government and of course households. But they cannot all be blamed on "global factors".

https://news.google.com/__i/rss/rd/articles/CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTYzNTk2Nzcz0gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYnVzaW5lc3MtNjM1OTY3NzMuYW1w?oc=5

2022-11-11 17:45:12Z

1628484700

Tidak ada komentar:

Posting Komentar