Gas prices have been soaring in countries across Europe, and there have been accusations that Russia may be seeking to exploit the situation for its own advantage.

Jake Sullivan, the US National Security adviser, recently expressed concern that Russia might be using energy as a political weapon.

"I believe they [Russia] should respond to the market demands for increased energy supplies to Europe," he said.

But how far is Russia responsible for current shortages and rising prices?

How much gas does Europe get from Russia?

Russia supplies about 50% of Europe's natural gas. Most of the rest comes from Norway and Algeria.

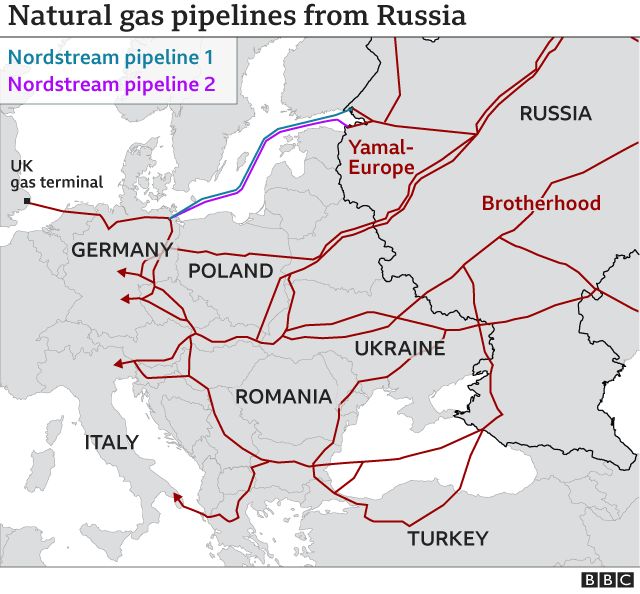

Russia sends gas to Europe through several main pipelines - such as the Nord Stream, the Yamal-Europe and the Brotherhood.

The gas is collected in regional storage hubs, and then distributed to different countries across the continent.

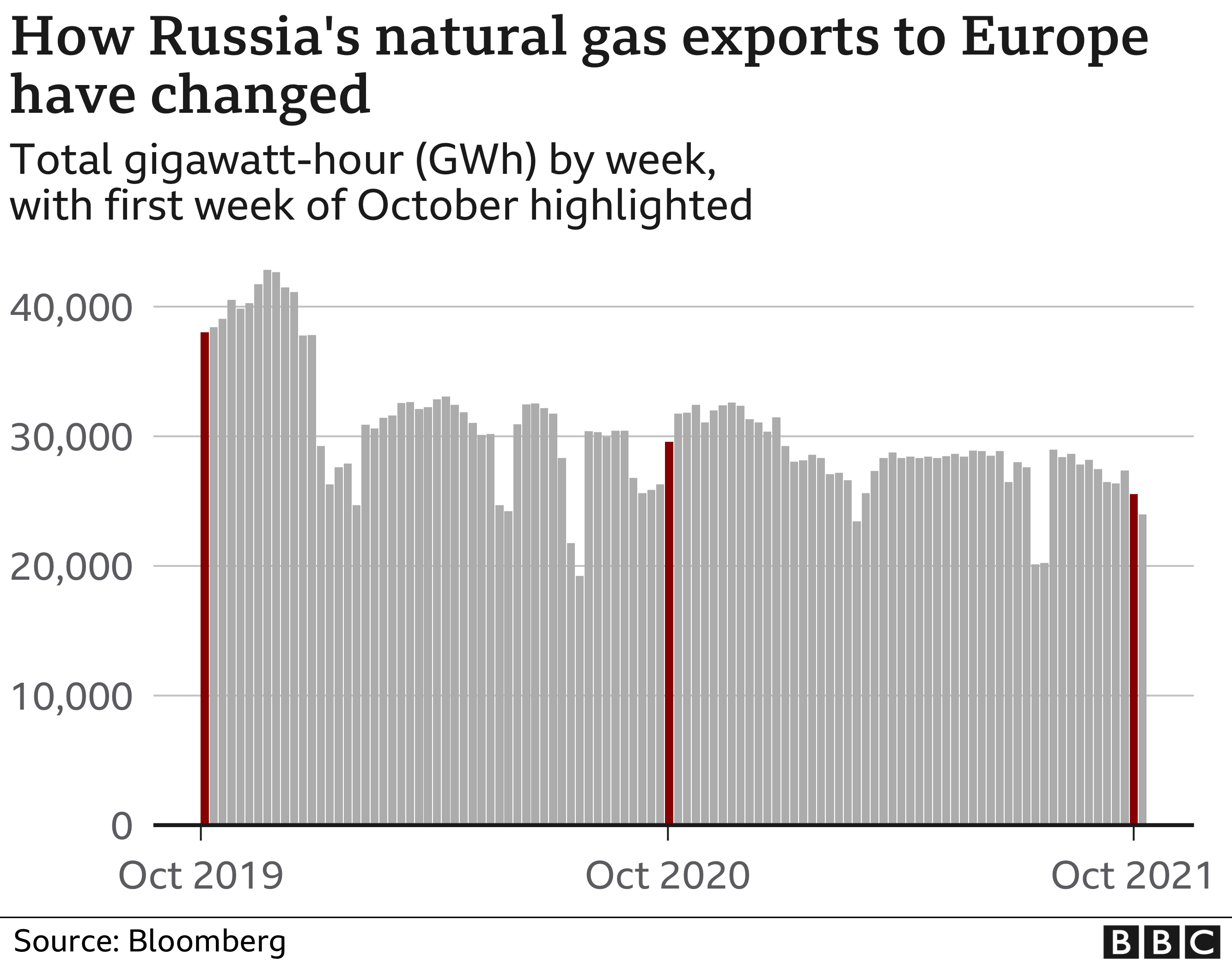

During the pandemic, overall gas exports from Russia to Europe fell because there was less demand.

Although it has picked up again in Europe, this downward trend has been continuing - with lower supply this year, especially via the Ukraine and Belarus pipelines.

This has led to stocks across Europe being depleted, which in turn is driving up prices.

Has Russia been meeting its commitments?

Gazprom, Russia's majority state-owned energy company, supplies gas to Europe under two different arrangements:

- Long-term contracts often lasting from 10 to 25 years

- "Spot" deals or one-off purchases for a fixed amount of gas

Gazprom itself describes long-term contracts as "fundamental to stable and sustainable gas supplies".

And it is understood that it has met its obligations to European buyers this year under these contracts.

However, the International Energy Agency's executive director, Fatih Birol, recently said it estimated Russia could supply 15% more gas if it wanted to.

Some analysts have suggested Russia could be holding back supplies to speed up approval of the newly-built Nord Stream 2 pipeline running directly from Russia to Germany.

This bypasses Ukraine, and has been met with objections on geo-political as well as environmental grounds, although Russia is keen for it to come on stream.

"A significant section of the mainstream European media has attributed this to Gazprom intentionally withholding supplies in order to force the German regulator and European Commission to approve Nord Stream 2," says Jack Sharples, of the Oxford Institute for Energy Studies.

But he adds that this analysis "is questionable".

German Chancellor Angela Merkel has said she was not aware of any instances where Russia had not met its contractual obligations.

"Russia can only deliver gas on the basis of contractual obligations and not just like that," she was quoted as saying.

But it is worth noting that "spot" sales do not appear to be happening in any significant quantity, going by data from Gazprom's own electronic sales platform.

Dr Sharples says: "This leads to the conclusion that Gazprom is supplying the volumes... under its long-term contracts - but it is not providing additional volumes beyond those contracts."

That view was also expressed by the EU's Energy Commissioner, Kadri Simson.

"Our initial assessment suggests that Russia is fulfilling its long-term contracts while not providing any additional supply." she told MEPs on 6 October.

Russia's deputy foreign minister, Sergey Ryabkov, told the BBC: "Gazprom has in fact started pumping out from its reserves into pipelines to stabilise the market."

And he added: "We have never been in a position to exert pressure through our energy supplies."

What's happened to stocks in Europe?

Gas storage across Europe is well below the 10-year average, with levels currently at about 75% of storage capacity, according to Gas Infrastructure Europe data.

The UK's gas storage is currently at full capacity - but Russia only provides about 5% of the country's usage, so it's less reliant on Russian imports than other European countries.

Russia's own gas storage is also down.

Adeline Van Houtte, a Europe analyst at the Economist's Intelligence Unit, says: "Currently, the Russian domestic gas market remains tight, with output already near its peak and winter is looming... limiting gas export capacity."

There are several other factors affecting the situation in Europe, such as:

- cold weather at the start of 2021 depleting stocks

- rising prices in spring and summer put traders off buying to sell later in the year

- limited supply from Norway because of maintenance issues

- reduction in other energy sources such as wind power

- growing demand for gas elsewhere in the world

Why is there a surge in demand for gas?

The economic rebound in the wake of the coronavirus pandemic has caused factories to ramp up production, pushing up demand for energy.

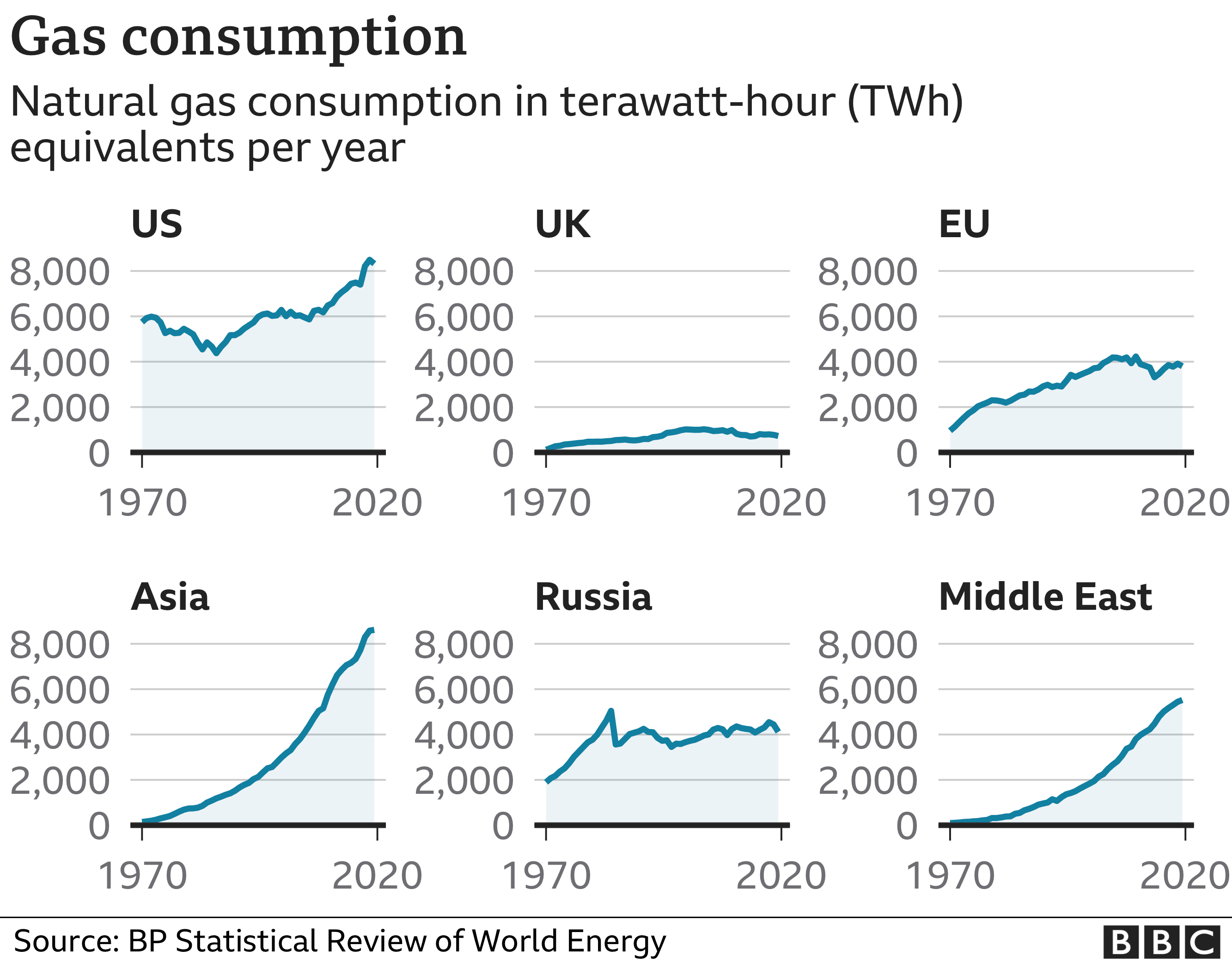

Europe is also facing increased competition for gas from other parts of the world.

In recent decades, demand for gas in some regions like Asia and the Middle East has risen sharply.

This has knock-on effects on the market for liquified natural gas (LNG), which makes up about a quarter of Europe's imports.

When demand for LNG is high, supplies tend to be diverted to Asia to take advantage of rising prices.

In addition, Russia has been expanding its gas exports to China, and in June inaugurated a gas processing plant in the far east of the country, which is predicted to become one of the biggest in the world.

Additional reporting by Kumar Malhotra and Daniele Palumbo

https://news.google.com/__i/rss/rd/articles/CBMiI2h0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzLzU4ODg4NDUx0gEnaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvNTg4ODg0NTEuYW1w?oc=5

2021-10-13 23:19:38Z

52781936834476

Tidak ada komentar:

Posting Komentar